Introduction

In everyday life, we face numerous financial decisions that affect our economic well-being. However, lack of financial education may hinder informed decision-making. In this article, we will explore how to create healthy financial habits through financial education and personal finance management. We will learn how to establish a solid financial future, avoid bad habits and face economic challenges effectively.

History and Background

Healthy financial habits are not a new concept. Since ancient times, the practice of effectively managing money has been fundamental to personal and collective economic development. Throughout history, prominent figures have highlighted the importance of financial education and smart money management. From the development of banking systems to the invention of currencies and banknotes, the world has experienced significant progress in understanding and applying healthy financial habits.

Detailed Analysis

The analysis of healthy financial habits covers a variety of aspects, from savings and investment to budget planning and risk management. The benefits of adopting these habits include the reduction of financial stress, the ability to face emergencies and the creation of long-term economic stability. However, there are also challenges, such as the temptation of unnecessary expenses, lack of knowledge of financial tools and lack of discipline to maintain healthy financial habits.

Comprehensive review

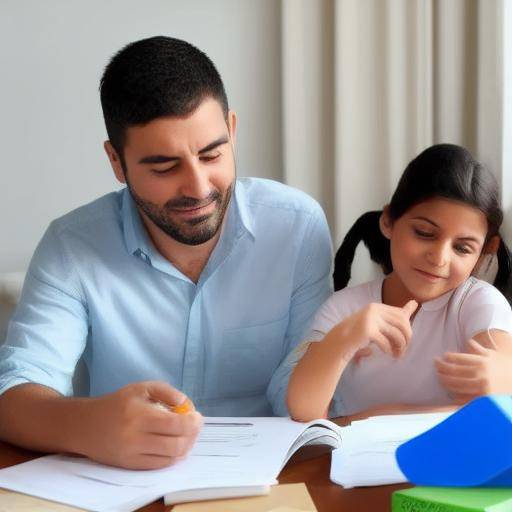

The practical application of healthy financial habits implies the incorporation of effective methods in daily life. Establishing a savings plan, investing in financial education and seeking professional advice are examples of good practices to ensure financial stability. However, it is essential to understand the different perspectives and opinions regarding financial management, as each individual can have unique financial needs and goals.

Comparative analysis

By comparing the concepts of financial habits, financial education and personal finance, it is crucial to understand their similarities, differences and possible synergies. While financial habits focus on action to effectively manage money, financial education encompasses the knowledge and skills needed to make informed financial decisions. For their part, personal finances deal with the individual management of financial resources, maintaining a balance between income and expenditure.

Practical Tips and Affordable Actions

To ensure healthy financial habits, it is vital to implement everyday habits that promote financial stability. Establishing a budget, avoiding unnecessary debts, investing in financial education and seeking professional advice are critical to achieving this goal. These practices can be carried out through the use of financial tools and the development of specific plans.

Conclusion

In conclusion, the creation of healthy financial habits through financial education and the management of personal finance is essential to ensuring a sound basis in the economic sphere. This process requires discipline, knowledge and a proactive approach to addressing financial challenges and achieving long-term goals. By adopting healthy financial habits, people can improve their financial well-being and build a more stable future.

Frequently asked questions

Why are healthy financial habits important?

Healthy financial habits are critical to ensuring effective money management, reducing financial stress and ensuring long-term economic stability.

How can I begin to improve my financial habits?

To improve your financial habits, start by setting up a budget, saving regularly, avoiding unnecessary debts and educating you on relevant financial issues.

###How does financial education influence the creation of healthy financial habits? Financial education provides the knowledge and skills needed to make informed financial decisions, which is essential to creating healthy financial habits. Through understanding financial concepts, management tools and investment strategies, people can develop responsible and efficient habits in managing their personal finances.

What are common mistakes that affect the creation of healthy financial habits?

Some common mistakes that may affect the creation of healthy financial habits include over-expendence, lack of financial planning, lack of savings and ignorance of basic financial management concepts. Identifying and correcting these mistakes is crucial to effectively establish healthy financial habits.

What is the role of long-term planning in managing personal finance?

Long-term planning plays a key role in managing personal finance, as it allows for clear financial targets, designing long-term savings and investment strategies and preparing for future financial contingency. Long-term planning provides a holistic view of the individual financial situation and encourages informed decision-making.

How do healthy financial habits influence general welfare?

Healthy financial habits have a significant impact on people's overall well-being, as they reduce financial stress, promote economic stability, allow for financial goals and provide a sense of security and control in relation to money management.

What is the role of professional financial advice in creating healthy financial habits?

Professional financial advice plays a crucial role in creating healthy financial habits by providing expert guidance, recommending customized strategies, advising on investment and financial planning, and helping to mitigate financial risks. Professional advice can be key to establishing a sound and sustainable approach to managing personal finance.

How can healthy financial habits contribute to long-term financial goals?

Healthy financial habits, such as regular savings, planned investment and responsible money management, are key pillars for achieving long-term financial goals. By maintaining healthy financial habits, people can work constantly towards the realization of their financial goals, either the purchase of a home, retirement or the education of children.

In conclusion, the creation of healthy financial habits through financial education and the management of personal finance is a fundamental process for ensuring financial stability and promoting long-term economic well-being. By adopting healthy financial habits and improving understanding of financial aspects, people can strengthen their financial position and achieve their goals more confidently.