In the digital era, financial education has become a crucial aspect for the integral development of children. Reading and educational resources play a key role in building a sound financial knowledge base from an early age. In this article, we will explore the importance of reading and educational resources in the financial education of children, as well as their impact on their personal and professional growth.

Introduction

The acquisition of financial skills from childhood is essential to preparing children to make sound financial decisions in the future. Reading and other educational tools provide a platform to inculcate financial concepts, encourage informed decision-making and promote financial responsibility. Throughout this article, we will break down the importance of these tools in the financial education of children, highlighting their role in developing a healthy financial mentality.

History and Background

The concept of financial education for children is rooted in the need to prepare future generations for a successful financial life. Throughout history, different approaches and methods have emerged to address this crucial aspect of development. From the first attempts to teach basic concepts of savings and spending to modern approaches that integrate innovative technology and pedagogy, the evolution of financial education has been remarkable.

In recent decades, recognition of the importance of financial literacy has led to a paradigm shift in how this issue is addressed. Early financial education has been shown to have a significant impact on lifelong financial decision-making. In addition, the integration of reading and educational resources has proved to be an effective strategy to promote experiential and sustainable learning in the financial sphere.

Detailed Analysis

The inclusion of financial concepts in books and other educational resources offers children the opportunity to become familiar with topics such as savings, budget, investment and money management in an accessible and attractive way. These resources not only provide theoretical knowledge, but also present real-life situations that enable children to apply and contextualize those concepts.

Research suggests that combining reading and educational resources in the financial education of children can improve their understanding of financial concepts, promote healthy financial habits and encourage informed decision-making. In addition, this methodology strengthens cognitive skills such as problem solving, critical reasoning and perspective-taking, which are fundamental to financial competition.

Comprehensive review

The practical application of financial education through reading and educational resources extends to various aspects of the daily life of children. From teaching them to understand the difference between needs and desires to inculcate skills to establish realistic financial goals, these educational methods provide the basis for a healthy and sustainable relationship with money throughout their lives.

As the global financial environment continues to evolve, financial education for children becomes even more relevant. The integration of reading and educational resources into formal and informal educational programmes can equip children with the necessary tools to understand and address contemporary financial challenges, such as responsible use of financial technology and debt management.

Comparative analysis

The contribution of books and other educational resources in financial education is emphasized by their ability to complement and enrich other teaching methods, such as direct instruction and experimental education. While each approach has its own advantages and limitations, the combination of these methods can provide children with a more holistic and lasting understanding of financial concepts, while fostering a sense of curiosity and exploration on the subject.

By comparing the influence of reading and educational resources on financial education, their ability to adapt to the various needs and learning styles of children is revealed. While some children may find the reading of stimulating and enveloping books, others may be more responsive to interaction with interactive and multimedia tools. In addressing this diversity, financial education can be guaranteed to be accessible and relevant to all children, regardless of their learning preferences.

Practical Tips and Accessible Advice

For parents, educators and caregivers interested in promoting the financial education of children through reading and educational resources, here are some practical tips that can be implemented:

- Exposing children to a variety of books on financial educationthat address concepts such as savings, budgeting and financial decision-making in a playful and understandable manner.

- Promoting interaction with games and educational applications related to financial educationwhich can make financial concepts more attractive and stimulating for children.

- Create opportunities to discuss financial issues in the family environmentusing daily situations to introduce concepts such as money management and short- and long-term planning.

Industry Perspectives and Expert Reviews

In consulting experts in the field of financial education and child development, the significant value of integrating reading and educational resources into the formation of durable financial skills in children is emphasized. Experts agree that early exposure to financial concepts through reading and other educational means can lay the foundation for informed and responsible financial decisions in the future.

According to pedagogy experts, reading books on financial education can serve as a vital starting point for promoting meaningful discussions on money and making financial decisions between parents and children. It also emphasizes the importance of adopting an integrated approach that combines financial literature with practical activities that enable children to apply and experience concepts learned in a tangible way.

Case Studies and Real Life Applications

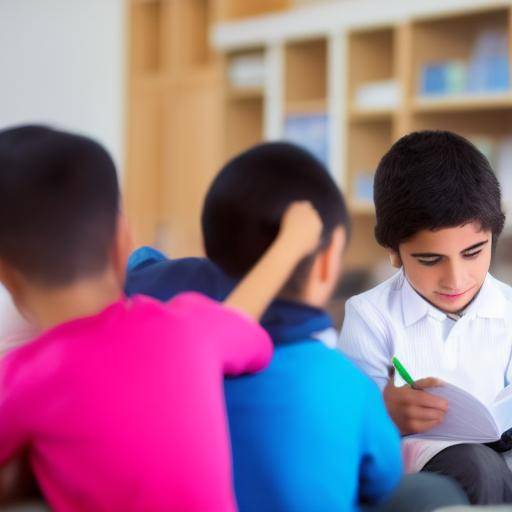

In order to illustrate the impact and effectiveness of reading and educational resources on children ' s financial education, cases of success and practical applications have shown significant results. These case studies cover a variety of scenarios, from formal educational environments to community initiatives and extracurricular programs, highlighting the versatility and applicability of these approaches in different contexts.

One of the outstanding cases of study is the "Leer para Prosperar" program, which has implemented the reading of books on financial education in primary schools of disadvantaged communities. Through this program, students have shown greater interest and understanding of financial concepts, which has resulted in increased participation in savings and financial planning activities.

Future Trends and Predictions

As the digital era progresses, it is expected that the integration of reading and educational resources into the financial education of children will continue to evolve and expand. The development of interactive and personalized educational tools is expected to adapt to the individual needs and preferences of children, promoting self- and self-directed learning.

Future trends also suggest a more holistic approach to financial education, which not only focuses on the transmission of theoretical knowledge, but also incorporates aspects such as the development of socio-emotional skills and the awareness of the influence of the environment in financial decisions. This comprehensive perspective seeks to prepare children to face the financial challenges of the real world, equipping them with the skills necessary to effectively navigate in a constantly changing economic environment.

Conclusions and FAQs

Conclusions

The importance of reading and educational resources in the financial education of children is undeniable, as it provides a solid basis for the development of fundamental financial skills. Through the combination of financial literature with innovative educational tools, a world of opportunities is opened for children to acquire an integral understanding of financial concepts and develop healthy financial habits that will accompany them throughout their lives.

Frequently asked questions

1. Why is it important to introduce financial concepts to children through reading and educational resources?

The early introduction of financial concepts through reading and educational resources provides children with a sound and contextualized understanding of money management, fostering the acquisition of fundamental financial skills from an early age.

2. What is the long-term impact of reading-based financial education on children?

Reading-based financial education can have a long-term impact by equating children with strong financial skills, promoting informed decision-making and fostering financial responsibility throughout their lives.

3. What are some effective ways of using reading and educational resources to teach financial education to children?

Some effective forms include the selection of books that address financial concepts attractively, the use of educational games related to financial education and the creation of opportunities to discuss financial issues in family environments.

4. How can schools and communities integrate reading-based financial education into their educational programmes?

Schools and communities can integrate reading-based financial education through extracurricular programmes, community libraries and partnerships with experts in financial education for children.

5. What are future trends in reading-based financial education and educational resources?

Future trends include the development of interactive and personalized educational tools, a more holistic approach to financial education and the integration of socio-emotional skills into educational programmes.

6. How can parents foster financial education through reading and other educational resources in the family environment?

Parents can encourage financial education through reading and other educational resources by selecting relevant books and educational tools, promoting money conversations and modeling healthy financial behaviors.

In short, the integration of reading and educational resources plays a key role in children ' s financial education by providing them with a sound financial knowledge base, promoting informed decision-making and promoting financial accountability throughout their lives.