Family budgeting is a key instrument for ensuring a sound and stable economy. However, the importance of involving children in this process is often underestimated. Financial education from an early age is essential for the development of sound financial skills in the future. In this article we will explore the importance of including children in managing the family budget, providing practical advice and strategies to inculcate a healthy financial mentality in them.

Early Financial Education

Financial education is a fundamental aspect that is often overlooked in the educational system. However, instilling financial concepts from an early age can lay the foundation for a healthy financial life. By involving children in the family budget, they are given the opportunity to understand the importance of managing money responsibly and making informed financial decisions.

History and evolution of financial education

Financial education has evolved considerably over the years. From the traditional lessons of savings to the understanding of investments and loans, modern financial education encompasses a wide range of concepts. We will explore the impact of financial education on society and how it has evolved to adapt to changing needs.

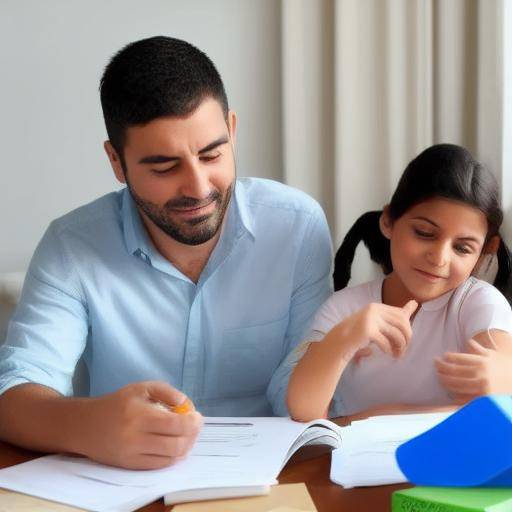

Importance of child participation in family budgeting

The participation of children in the family budget not only gives them the opportunity to learn about finance, but also teaches them to appreciate the effort needed to earn and manage money. This early understanding can lead to a healthier relationship with money in adulthood, reducing the likelihood of poor financial management.

Benefits and challenges of child participation in the family budget

The participation of children in the family budget opens opportunities to teach them about savings, responsible spending and prioritize needs. However, this can present challenges in terms of understanding and patience. We will explore the benefits and challenges of this participation, providing strategies to address any potential obstacles.

Practical tips for involving children in the family budget

The involvement of children in the family budget can be done in various ways. To assign them financial tasks to involve them in cost and savings discussions, there are effective strategies to promote a healthy understanding of finance. We will present practical advice supported by experts in financial education to help parents initiate this process effectively.

Reflect the future of financial education and the participation of children in family budgeting

Finally, we will seek the future of financial education and the participation of children in family budgeting. How do financial teaching methods evolve? What emerging trends could influence how we involve children in managing family finance? These reflections will provide an intriguing view of future possibilities in this field.

Conclusion

The involvement of children in the family budget is a comprehensive strategy to promote a sound understanding of finance from an early age. By giving them the opportunity to participate in financial decisions and understand the importance of budgeting, we are preparing future generations for a successful financial life. While it can present challenges, long-term benefits are significant, and this investment in child financial education can lay the foundation for a stable and prosperous financial future.

Frequently asked questions

1. Why is it important to involve children in the family budget from an early age?

The involvement of children in the family budget from the early age is crucial to teaching them strong financial skills that will serve them throughout their lives. This participation provides a direct understanding of how money is managed at home and instills a responsible financial mentality from an early stage.

2. How can difficulties be addressed in involving children in family budgeting?

It is essential to adopt a patient and understanding approach by involving children in family budgeting. Clear communication, the opportunity to make financial decisions and establish realistic expectations are effective strategies to address the challenges that may arise.

3. What are some practical ways to involve children in managing family money?

The allocation of financial tasks, such as managing a small amount of money or helping to compare prices during family purchases, can be a practical way of involving children in managing family money. In addition, openly discussing family expenses and savings can provide a deeper understanding of financial decisions.

4. How can the participation of children in the family budget influence their emotional and cognitive development?

The involvement of children in the family budget can promote the development of emotional and cognitive skills, such as patience, informed decision-making and understanding of the consequences of financial elections. It also gives them the opportunity to feel valued and responsible.

5. What is the long-term impact of instilling a healthy financial mentality in children?

Instilling a healthy financial mentality in children can have a significant long-term impact. It helps them make informed financial decisions in adulthood, provides them with the ability to face financial challenges with confidence, and contributes to future financial stability and prosperity.

6. What role does financial education play in the overall development of children?

Financial education plays an integral role in the overall development of children. It teaches them practical skills and provides them with a fundamental understanding of the importance of managing money responsibly, which can positively influence their financial well-being and quality of life in the future.

Ultimately, financial education and the participation of children in family budgeting are crucial aspects that not only affect the financial stability of the family at present, but also lay the foundation for a promising financial future for future generations.