Introduction

The real estate market is a sector that plays a key role in investment decisions. From emerging trends to detailed analysis and strategic decisions, this article will address the importance of understanding and taking advantage of these variables in the field of investment. Throughout the content, we will explore how real estate trends, deep analysis and strategic decisions can significantly impact the profitability and growth of investments.

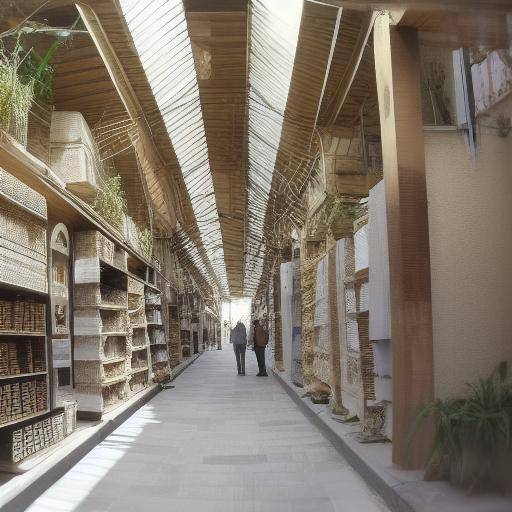

History of the Real Estate Market

Origins and Evolution

The real estate market has its roots in antiquity, but its evolution towards a modern market has been remarkable in recent centuries. From ancient civilizations to the digital era, the real estate market has experienced significant changes that have shaped its currentity.

Key issues and developments

During its development, the real estate market has undergone crucial moments that have impacted its structure, regulations and dynamics. Stories such as the creation of mortgages, the real estate bubble, and the digital transformation have left an imprint in this sector.

Historical Case Analysis

The study of historical cases, such as the rise and fall of entire cities by real estate speculation, allows us to understand how past events have influenced current trends and offer us valuable lessons for decision-making.

Deep Analysis of the Real Estate Market

Emerging trends

The trends in the real estate market are continually evolving. From accelerated urbanization to the boom in sustainable housing, it is crucial to be aware of these trends to identify investment opportunities.

Challenges and Opportunities

Real estate market analysis reveals significant challenges, such as market volatility and associated risks, but also offers attractive opportunities in terms of valuation, passive income and portfolio diversification.

Relevant Data and Statistics

The support of analysis with specific data, such as occupation rates, financial performance and growth projections, helps to inform investment decisions in the real estate market.

Importance of Strategic Decisions

Investment diversification

Strategic decisions in the real estate market can contribute significantly to the effective diversification of investments, reducing risk and increasing return potential.

Funding strategies

The choice of appropriate financial strategies, such as the use of real estate loans or collective financing, can influence the profitability of investments in the real estate market.

Impact on Neto Heritage

Making successful decisions on the real estate market can have a direct impact on the net assets of investors, highlighting the importance of carefully considering each movement.

Comparative analysis

Real Estate Trend Comparison

Comparison of real estate trends at the national and international levels provides a global vision that can be crucial to making informed and diversified investment decisions.

Differences in the Analysis of Segments

Real estate market dynamics can vary widely between segments, such as residential, commercial or industrial. Understanding these differences is vital for disciplinary decision-making.

Synergies between Different types of investments

Exploring synergies between the real estate market and other types of investments allows identifying opportunities for diversification that can improve the efficiency of investment portfolios.

Practical Tips and Accessible Recommendations

Considerations to the Moment of Investing

Before realizing a real estate investment, it is crucial to consider factors such as location, growth potential and macroeconomic conditions. These elements can significantly impact long-term performance.

Intelligent Diversification

Smart diversification involves not only considering different types of properties, but also exploring diverse and geographically separate real estate markets to mitigate the risk of concentration.

Risk and Return Analysis

Executing a thorough analysis of the risks and potential returns of real estate investments is essential to making informed decisions and aligning expectations with the reality of the market.

Perceptions of Industry and Expert Reviews

Prospectives

The views and perceptions of industry professionals, such as real estate agents, tax collectors and financial analysts, provide a valuable perspective that complements the analysis of data and trends.

Future trends and trends

The approach to future trends in the real estate market based on knowledge of experts provides a strategic vision that can influence long-term investment decisions.

Reflections of Market Leaders

The reflections and recommendations of real estate market leaders provide a direct view of successful strategies and current challenges, offering lessons applicable to investment decisions.

Case Studies and Practical Applications

Illustrative cases

The illustrative cases of successful and failed real estate investments highlight the critical factors to consider when making decisions, providing valuable lessons based on real experiences.

Practical Applications

The practical applications of successful real estate investment strategies in specific contexts offer a detailed view of real implementation and its consequences.

Lessons Learned

Case analysis and practical applications provide an opportunity to draw lessons learned that can enrich future investment decisions.

Future Trends and Predictions

Technological Evolution and Digitalization

Technological evolution and digitalization continue to transform the real estate market, creating new opportunities and challenges that must be considered in future investment decisions.

Sustainability and Social Responsibility

The growing approach to sustainability and social responsibility in the real estate market influences future trends and predictions, providing opportunities to align investments with sustainable values.

Demographic Changes and Urbanization

Demographic changes and urbanization will impact the demand and supply of real estate, which will require continuous analysis to adapt investment strategies to these changing trends.

Conclusions and FAQs

Conclusions

The role of the real estate market in investments is crucial, as understanding trends, thorough analysis and strategic decision-making can determine the success of long-term investments.

Frequently asked questions

**Question 1: What are the key trends to take into account in investing in real estate?**Key trends include urbanization, sustainability, and real estate market digitalization.

**Question 2: How does risk analysis and returns to real estate investment decisions affect?**Risk and return analysis provides a informed evaluation that helps make decisions with realistic expectations.

**Question 3: What impact do demographic changes have on real estate investment strategies?**Demographic changes can influence the demand for certain types of properties and locations, which requires strategic adaptation.

**Question 4: What is the role of sustainability in future trends in the real estate market?**Sustainability is impacting future trends by boosting demand for eco-friendly and socially responsible properties.

**Question 5: How can investors intelligently diversify their real estate investments?**Smart diversification involves considering different types of properties and exploring diverse and geographically separate real estate markets.

**Question 6: What role do strategic decisions play in the profitability of real estate investments?**Strategic decisions can directly impact the profitability of real estate investments, influencing diversification, financing and risk management.

In short, the real estate market plays a crucial role in investment decisions, and understanding trends, conducting detailed analyses and making informed strategic decisions are critical to maximizing return potential and managing risks in real estate investments.

With this content, readers will be able to gain a deeper understanding of the complexities, opportunities and challenges of the real estate market, allowing them to make more informed and strategic investment decisions in this sector fundamental to the economy.